Custom Private Equity Asset Managers - The Facts

Wiki Article

Some Ideas on Custom Private Equity Asset Managers You Need To Know

(PE): spending in firms that are not publicly traded. About $11 (https://fliphtml5.com/homepage/ejble). There may be a couple of things you don't comprehend about the sector.

Personal equity firms have an array of investment preferences.

Due to the fact that the best gravitate toward the bigger bargains, the center market is a considerably underserved market. There are more sellers than there are very experienced and well-positioned money specialists with extensive buyer networks and resources to manage a bargain. The returns of private equity are normally seen after a couple of years.

The Ultimate Guide To Custom Private Equity Asset Managers

Flying listed below the radar of big international corporations, a number of these small firms commonly give higher-quality client service and/or particular niche product or services that are not being provided by the big empires (http://tupalo.com/en/users/5860500). Such advantages draw in the rate of interest of personal equity firms, as they have the insights and wise to make use of such chances and take the company to the following level

my explanationPrivate equity financiers have to have trustworthy, qualified, and trustworthy management in area. Many supervisors at profile business are given equity and bonus offer compensation frameworks that award them for hitting their financial targets. Such placement of goals is normally needed before a bargain obtains done. Private equity chances are often out of reach for people that can not invest millions of bucks, yet they shouldn't be.

There are guidelines, such as limitations on the aggregate amount of cash and on the number of non-accredited financiers (TX Trusted Private Equity Company).

The 9-Minute Rule for Custom Private Equity Asset Managers

An additional negative aspect is the lack of liquidity; once in an exclusive equity transaction, it is not simple to obtain out of or offer. With funds under management currently in the trillions, exclusive equity firms have actually ended up being appealing investment cars for wealthy people and organizations.

For years, the features of personal equity have made the asset course an appealing proposition for those that might participate. Now that accessibility to private equity is opening approximately more individual financiers, the untapped possibility is coming true. So the question to take into consideration is: why should you invest? We'll start with the major disagreements for purchasing personal equity: Just how and why personal equity returns have actually historically been greater than various other possessions on a variety of levels, Just how including personal equity in a profile influences the risk-return profile, by assisting to branch out against market and intermittent risk, After that, we will certainly lay out some vital considerations and threats for exclusive equity investors.

When it comes to introducing a new asset into a portfolio, one of the most basic consideration is the risk-return account of that property. Historically, exclusive equity has actually shown returns similar to that of Arising Market Equities and more than all various other standard possession classes. Its relatively low volatility paired with its high returns produces an engaging risk-return profile.

Some Known Factual Statements About Custom Private Equity Asset Managers

In fact, exclusive equity fund quartiles have the best series of returns throughout all different property classes - as you can see below. Approach: Inner rate of return (IRR) spreads out computed for funds within classic years separately and afterwards averaged out. Mean IRR was determined bytaking the standard of the typical IRR for funds within each vintage year.

The takeaway is that fund selection is vital. At Moonfare, we lug out a strict choice and due persistance process for all funds detailed on the platform. The impact of adding exclusive equity into a profile is - as constantly - reliant on the portfolio itself. A Pantheon research from 2015 recommended that including personal equity in a portfolio of pure public equity can unlock 3.

On the various other hand, the most effective private equity firms have accessibility to an even larger swimming pool of unidentified chances that do not deal with the very same examination, along with the resources to do due persistance on them and determine which deserve investing in (Syndicated Private Equity Opportunities). Spending at the ground flooring means higher threat, but also for the companies that do be successful, the fund gain from greater returns

The Of Custom Private Equity Asset Managers

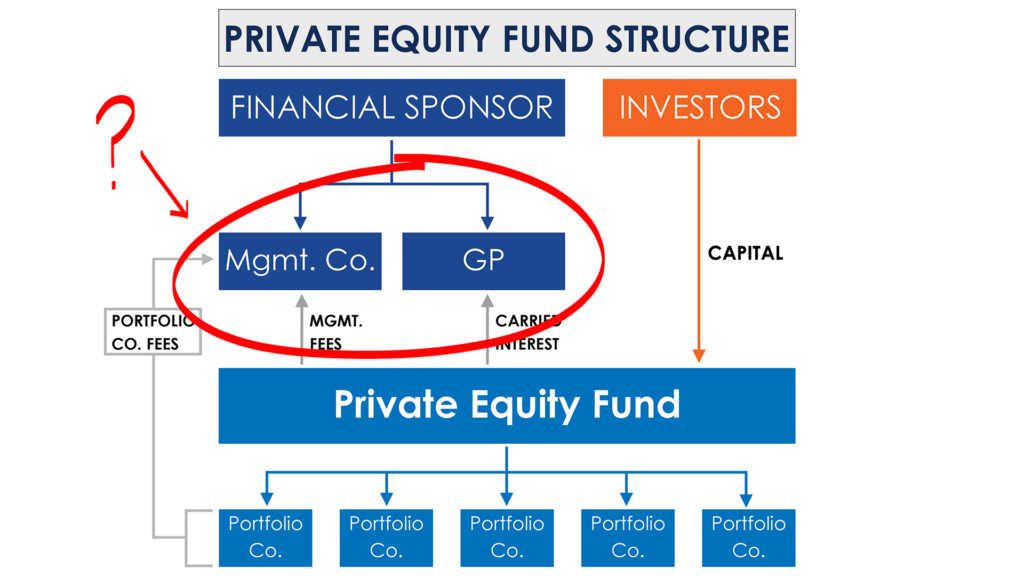

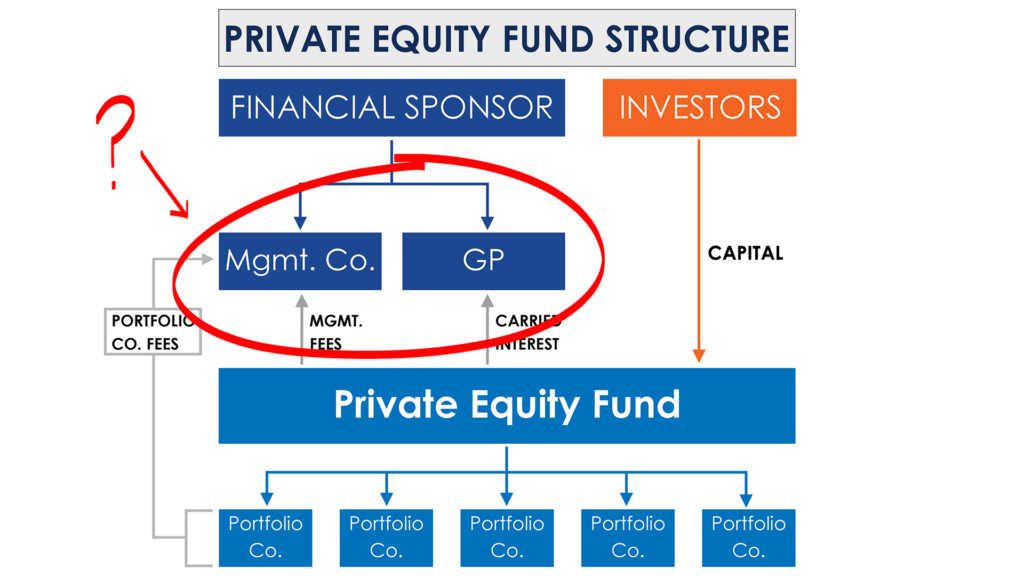

Both public and private equity fund supervisors dedicate to spending a percent of the fund however there stays a well-trodden problem with straightening passions for public equity fund administration: the 'principal-agent trouble'. When a capitalist (the 'principal') hires a public fund supervisor to take control of their funding (as an 'agent') they delegate control to the manager while keeping ownership of the assets.

In the situation of exclusive equity, the General Companion does not just earn an administration cost. They likewise make a percent of the fund's earnings in the kind of "lug" (normally 20%). This guarantees that the passions of the manager are aligned with those of the capitalists. Exclusive equity funds additionally reduce an additional form of principal-agent issue.

A public equity financier inevitably wants something - for the monitoring to increase the stock rate and/or pay out returns. The capitalist has little to no control over the choice. We revealed above exactly how several private equity approaches - specifically bulk acquistions - take control of the running of the company, ensuring that the lasting worth of the business comes first, rising the roi over the life of the fund.

Report this wiki page